How to set realistic financial goals for 2025?

Share

Setting financial goals: it might sound like something only the super-organized do, but believe me, anyone can do it. And why wait? 2025 is the perfect time to start fresh and get your finances in order. Whether you want to save for a dream vacation, a new gadget, or finally pay off that pesky debt, a clear plan will get you there. In this blog post, we'll walk you through all the steps to help you set realistic and achievable goals. Grab your coffee (or tea) and let's get started!

Okay, let's first talk about why you should actually do this. Financial goals give you a sense of direction. Without goals, it's very easy to spend your money on spontaneous purchases (hello, online shopping!) instead of on the things you truly care about.

Why setting financial goals is important

Goals give you a clear idea of what you're working towards. They provide structure and prevent your money from simply disappearing. Moreover, setting goals can reduce stress because you know you're working towards a solution, like building an emergency fund or paying off debt. So yes, it's truly a win-win.

Choose SMART goals

Setting goals is more than just saying, "I want to save more." How much more? When? What for? This is where the SMART principle comes in:

- Specific: What do you want to achieve? For example: "I want to save €3,000 for a vacation."

- Measurable: How do you know you're on the right track? You save a fixed amount each month.

- Acceptable: Does this fit within your budget and lifestyle?

- Realistic: Is it feasible?

- Time-bound: By what date do you want to achieve this goal?

For example: "I want to save €1,500 for a new laptop in 10 months." That means €150 per month. Doable, right?

Analyze your current financial situation

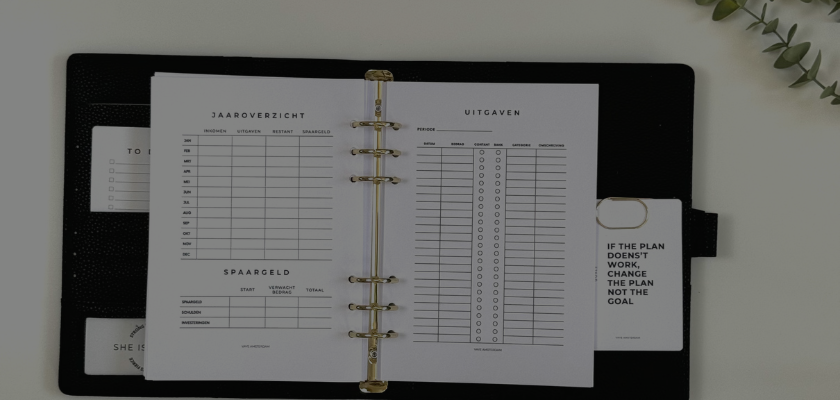

Before making any big plans, it's wise to take stock of your current situation. How much do you earn? How much do you spend? And more importantly, how much do you have left? Use a budget planner to gain insight.

Take your bank statements and create a list of your income and expenses. Tools like a budget binder can help with this. A budget binder makes it easy to categorize your expenses and track your savings. This gives you a clear picture of where you can potentially save.

Break big goals into small steps

Thinking about a large savings goal, like €10,000 for a down payment on a house, can be quite overwhelming. That's why it's smart to break down large goals into smaller, more manageable chunks.

Let's say you want to save €10,000 in two years. That works out to €5,000 per year, or about €417 per month. Can't afford to spend that much all at once? No problem, start small. For example, try setting aside a smaller amount each week. Small steps make big goals much more achievable.

Automate your savings behavior

Want to make things easier for yourself? Automate your savings. Set up an automatic transfer to your savings account immediately after your paycheck arrives. That way, you won't even "miss" the money, and you'll consistently work towards your goals.

For extra visual motivation, you can also use a savings challenge . This not only helps you track your progress but also makes the process more fun and manageable.

Make a plan for unexpected expenses

Life is full of surprises. A broken washing machine, an unexpected car repair—it can all happen. That's why an emergency fund is an essential part of your financial goals.

How much do you need? A good starting point is three to six months' worth of fixed expenses. Set a separate savings goal for your emergency fund and use a transparent piggy bank, for example. To physically keep the money separate. This makes it visual and tangible.

Stay motivated and track your progress

The hardest part about saving? Staying motivated, especially with long-term goals. Here are a few tips:

- Make your progress visual: Use a tracker or budget binder to see how much you've already achieved.

- Reward yourself: Set small rewards for when you reach a milestone, such as 25% of your goal.

- Get others involved: Share your goals with friends or family. They can motivate you to keep going.

Another way to stay motivated is to work with savings challenges, like the 52-week savings challenge . Each week you set aside a small amount, which can quickly add up to a nice total.

Tips to save money

Want to reach your goals faster? Then saving is a smart move. Here are a few simple tips:

- View subscriptions: Are you paying for things you don't use? Cancel them. Use a subscription tracker to keep track of every month of the year.

- Cook at home: It can be so much cheaper than eating out.

- Use cash stuffing: This method involves using cash for specific expenses. Our cash envelopes are perfect for this.

- Keep an eye on offers: Whether it's groceries or clothes, shop smart.

Conclusion

Setting financial goals might sound like a daunting task, but with the right approach, it's not only achievable but also enjoyable. Whether you have a big savings goal or just want to get a better handle on your finances, clear planning and the right tools will get you there.

Start today by assessing your current situation, using a budget binder or savings planner, and breaking down your goals step by step. Check out our savings products for extra inspiration and tools to help you make 2025 your best financial year. Go for it – you've got this!