How do you start cash stuffing?

Share

Are you always surprised at how quickly your money disappears? Your paycheck arrives in your account, and before you know it, it's gone, without you knowing exactly where it went. If you want to get a better handle on your money and make saving easier, cash stuffing might be for you.

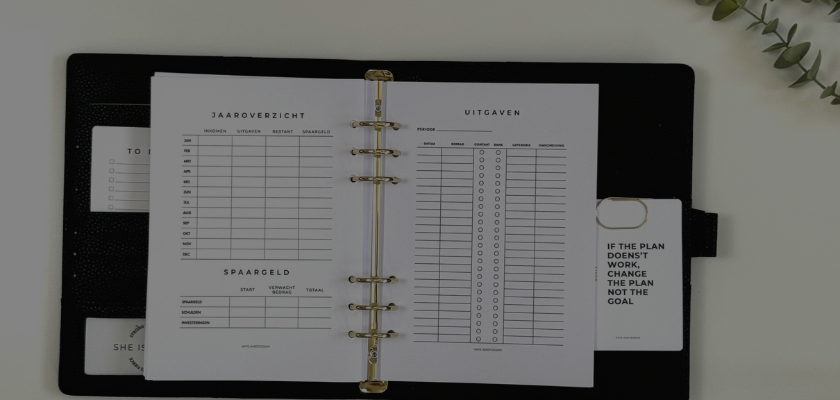

Cash stuffing is a simple and streamlined way to better manage your money. No complicated budgeting apps, no boring Excel spreadsheets—just cash, neatly organized in envelopes. In this blog post, I'll explain step-by-step how to get started and how you can use Vaye Amsterdam products to keep track of your budget.

What is cash stuffing?

Cash stuffing is a super simple way to organize your money. You collect cash, divide it into different categories, and put it in separate envelopes or a budget binder .

Examples of categories:

- Groceries

- Gasoline or public transport

- Outings & entertainment

- Gifts and parties

- Saving for a vacation or emergency

The idea is simple: once an envelope is empty, it's gone. This means you won't secretly spend extra with your debit card. This helps you manage your money more consciously and prevents you from suddenly running out of money at the end of the month.

Why does cash stuffing work?

You might be thinking, "Why would I do this when I can just pay with my debit card?" Good question. But that's precisely the problem. Contactless payments are so easy that you often don't even realize how much you're spending.

1. You become more aware of your expenses

When you literally have to take money out of an envelope to pay for something, it feels much more "real" than a quick debit card payment. You think more carefully before spending your money.

2. Never run out of money again

With cash stuffing, you give your money a purpose upfront . Everything is neatly divided, and you know exactly what's left. No more surprises at the end of the month.

3. Achieve savings goals more easily

Want to save for a vacation, a new phone, or just build a nest egg? Create a separate envelope for it and put a sum in it each month. You'll be amazed at how quickly your savings grow without you even realizing it.

Immediately budget planner you can keep track of your savings goals even more easily.

What do you need to start cash stuffing?

You don't actually need much. With a few handy tools from Vaye Amsterdam , you can get started right away:

- Budget binders – A beautiful binder to neatly store all your cash envelopes. View them here.

- Cash Envelopes – Labeled or personalized cash envelopes that allow you to separate your money by category. Available here.

- Expense tracker or budget planner – Helps you keep track of your income and expenses. View the budget planner here.

- Cash – Take cash and have smaller bills so you can easily divide it.

A starter package is perfect if you want to arrange everything at once.

Step-by-step: How to get started with cash stuffing

Step 1: Create a budget

Before you start allocating money, you first need to know how much you can spend. Grab a notebook or use a budget planner and write down:

- Income – What comes in each month (salary, allowances, extra income)?

- Fixed costs – Rent/mortgage, insurance, subscriptions. These remain in your account.

- Variable expenses – Such as groceries, gas, and outings. This is the money you'll distribute across your allowances.

💡 Tip: Check your banking app for your expenses over the past three months to get an idea of your average costs.

Step 2: Determine your categories

What are your monthly expenses? Make a list and determine how much you need for each category. For example:

- Groceries: €300

- Entertainment: €50

- Petrol/Public transport: €75

- Save holiday: €100

- Gifts & parties: €40

Use labels or a dashboard set to neatly categorize your envelopes.

Step 3: Collect cash

Go to the bank and withdraw the amount you need for your variable expenses. Ask for smaller bills (€5, €10, €20) so you can more easily divide the amount.

💡 Tip: Do this once a month or spread it out over a week, whatever works for you.

Step 4: Fill your envelopes

Grab your budget binder and cash envelopes and put the money into the appropriate categories.

Rule: If an envelope is empty, it's gone. Don't borrow money from another envelope unless you absolutely have to.

Step 5: Track your expenses

Every time you spend something, write it down in your spending tracker . This helps you gain insight into your spending and adjust your budget if necessary.

💡 Extra tip: Schedule a moment at the end of the month to check in on how you're doing.

Common Mistakes (and How to Avoid Them)

- Creating too many categories → Keep it simple! Start with 4-6 categories.

- Don't keep a buffer → Always make sure you have some extra money in your account for emergencies.

- Lack of Consistent Tracking → Make it a habit to track your envelopes and expenses weekly.

Why Cash Stuffing Works (For You Too!)

Cash stuffing helps you manage your money more consciously, reach your savings goals faster, and experience less financial stress. By dividing everything upfront and physically seeing what you're spending, you gain much better insight into your finances.

Whether you want to save for a vacation, a new car, or just want more control over your money —cash stuffing works!

Want to get started right away? Check out all the handy products from Vaye Amsterdam and start organizing your budget today.

🚀 Ready? Set. Save!