How to stay motivated during a savings challenge: here's how!

Share

Starting a savings challenge is exciting. You're motivated, have a goal in mind, and feel ready to go. But let's be honest: after a few weeks, it can get tough. The novelty wears off, you might not see much progress, and the temptation to buy that one beautiful coat is getting stronger. Don't worry! You're not alone, and we're here to help. In this article, we share tips to keep your motivation high, so you can easily achieve your savings goals.

1. Set realistic savings goals

Let's start with the basics: make sure your goal is achievable. Dreaming about a fat savings account is great, but if you're struggling to make ends meet, setting aside €500 a month might not be realistic. Start small. Set a goal that fits your budget and lifestyle.

A good rule of thumb? Look at your income and expenses and determine what you can truly afford. Maybe that's €20 a week, or €50 a month. Whatever it is, make it concrete. For example, use a budget planner to clearly outline your goals.

2. Visualize your goal

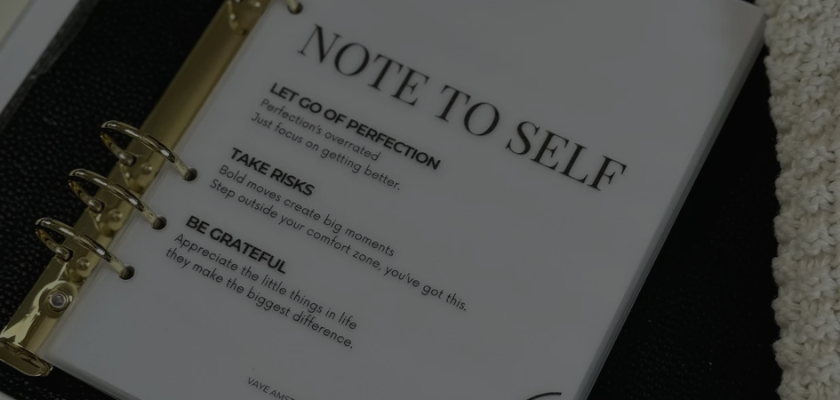

You have a goal, but how do you keep it in focus? By making it visible! Visualization helps you stay focused. Hang up a picture of what you want to achieve, like that dream vacation or that new bike. Or use a savings goal tracker where you can check off each step.

Another fun way? Use a transparent piggy bank. This way, you can literally see your savings grow. At Vaye Amsterdam , you'll find handy and stylish options to boost your motivation.

3. Break your challenge into small steps

A big savings goal can be overwhelming. That's why it's smart to break your challenge down into smaller, manageable steps. Let's say you want to save €1,200 in a year. That sounds like a lot, but if you break it down, it's only €100 a month or €25 a week. That immediately feels more achievable, right?

Reward yourself for achieving these small milestones. If you've successfully saved for a month, treat yourself to a small treat, like a nice cup of coffee or a relaxing evening at home with your favorite TV show. As long as your reward fits within your budget, you'll stay motivated.

4. Make it fun with creative savings challenges

Who says saving has to be boring? Make it a party! There are so many fun ways to do a savings challenge. How about the €5 challenge? Here, you set aside every €5 bill you find. Or try the reverse 52-week challenge, where you start with a small amount (for example, €1 in week 1) and increase it each week.

These methods make saving not only more fun, but also more exciting. It almost feels like a game. Check out our budget binders and cash envelopes to organize your savings challenge even better.

5. Ensure accountability

Saving doesn't have to be a lonely journey. Share your goals with a friend, family member, or colleague. Or even better: take on a savings challenge together! Having a "savings buddy" provides extra motivation. You can encourage each other and hold each other accountable when things get tough.

Don't have anyone close to you? No problem! Join an online community or share your progress on social media. Use hashtags like #Spaarchallenge or #SparenSamen to find others with the same goal. Saving together is always more fun!

6. Track your progress

Tracking your progress is essential for staying motivated. There's nothing better than seeing how far you've come. Use a savings challenge tracker, a spreadsheet, or a dedicated budget planner. By visualizing your progress, you'll stay aware of your efforts.

At Vaye Amsterdam Find handy planners to help you stay organized and motivated. Record every step you take and celebrate your successes, no matter how small!

7. Make saving a habit

Ultimately, it's all about consistency. Saving needs to become a habit, just like brushing your teeth. Schedule a fixed time each week or month to put money aside. For example, every Friday after work or at the beginning of each month as soon as your paycheck arrives.

Automate where possible. Set up an automatic transfer to your savings account. This way, you don't have to think about it anymore, and saving becomes a regular part of your routine.

8. Be flexible but don't give up

Sometimes life doesn't go as planned. You might have unexpected expenses or find yourself a little short on cash. That's okay. The most important thing is not to give up. Adjust your savings goals temporarily if necessary, but stay consistent.

It helps to maintain a separate buffer for unexpected expenses, so your savings challenge isn't jeopardized. Start small and build it up gradually.

9. Remember why you started

If your motivation starts to wane, remind yourself why you started this savings challenge. What do you want to achieve? How will you feel when you reach your goal? Imagine that moment: landing that dream trip, paying that big bill stress-free, or enjoying the feeling of financial freedom.

Reminders of your why can re-inspire you to keep going, even when things get tough.

Conclusion

Staying motivated during a savings challenge can be tricky, but these tips will make it much easier. Start with realistic goals, track your progress, and keep saving fun and visually appealing. Use tools like budget binders and piggy banks to make your journey easier and more motivating.

You can do this. Every little bit you save brings you closer to your goal. And remember: the road to financial freedom begins with that first step. So, what are you waiting for? Start your savings challenge today and make your dreams come true!